Insights, Ideas and News

Getting You Organized

Organization = Clarity and Understanding

One of the most daunting elements of embarking on a financial plan is the reality that you need to be organized in how you store and access your information as well as organized in your mind. In other words you need to know what you have and where it all is. Vested Wealth Advisors helps with this in two ways.

All clients receive a Financial Planning Organizer Kit (from www.homefileorganizer.com/homefileorganizer.aspx). This is comprehensive set of organizing tabs for your home files. Its simple but a powerful tool in putting papers where they should go.

For Wealth Management clients, we provide the online Client Wealth Portal. Not only is is a state-of-the-art tool for tracking your entire financial picture at one location, it has a ‘vault’ feature that easily allows clients to upload and safeguard their critical information and documents behind password protection. The video above is about this tool.

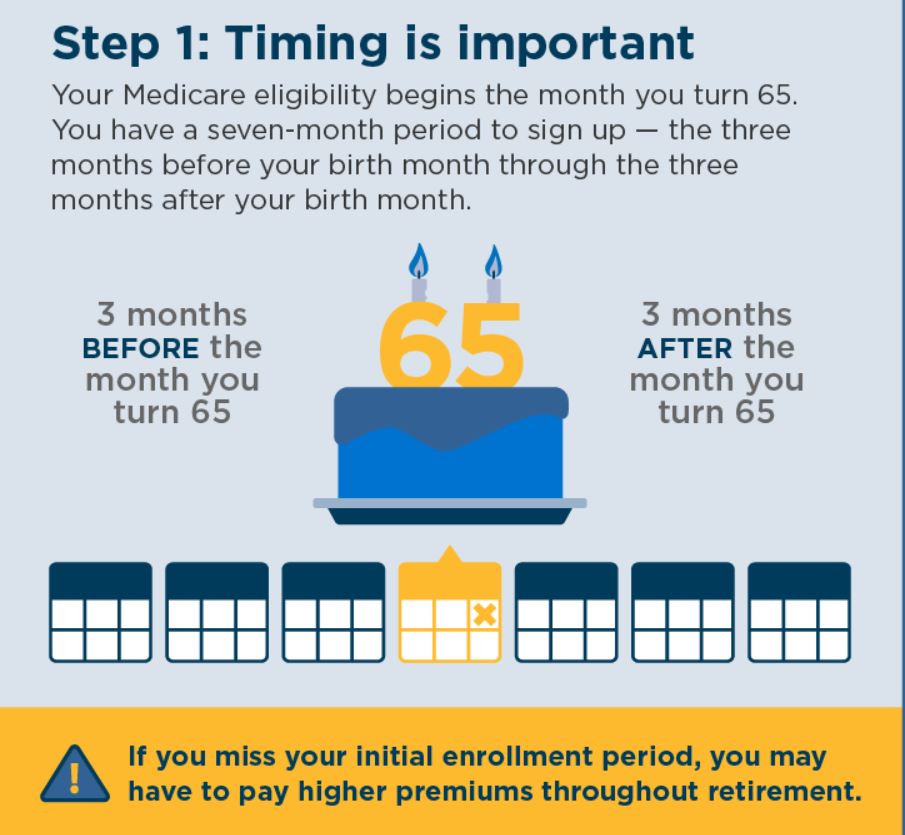

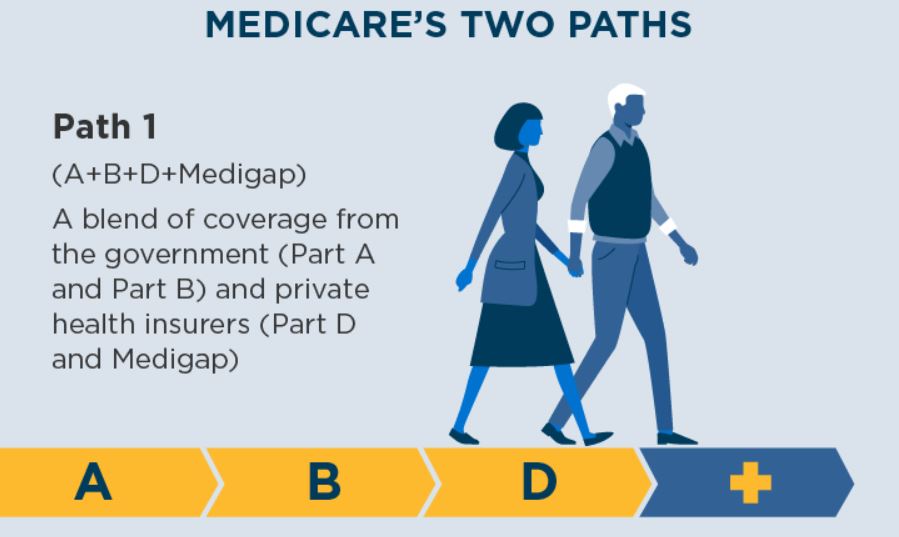

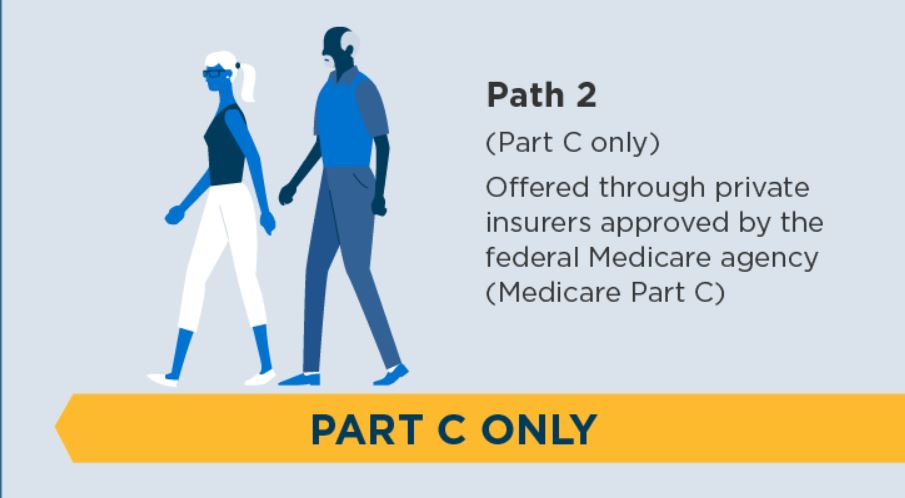

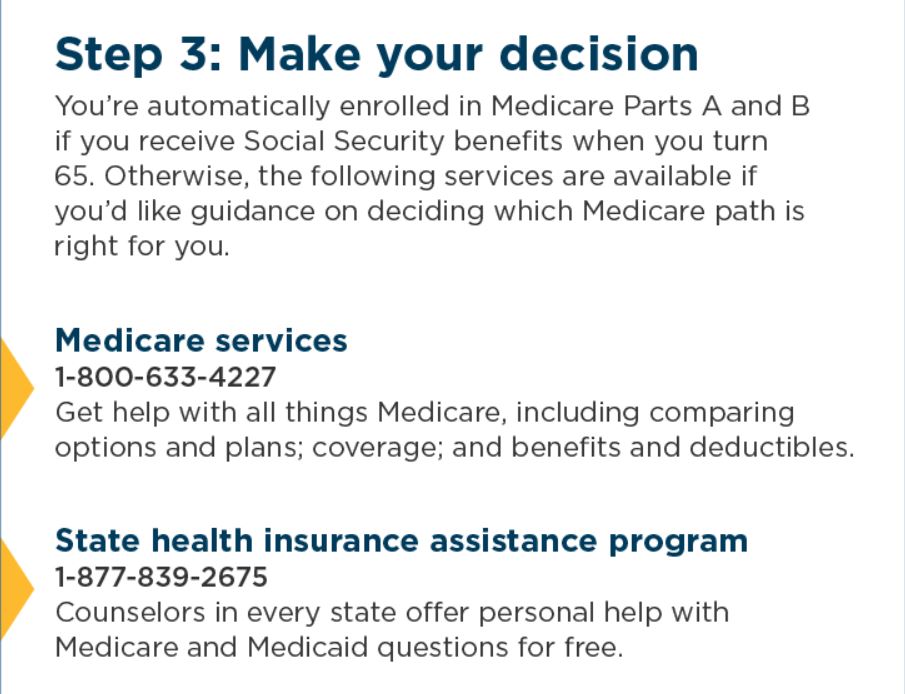

Medicare Basics

The Range of Annual Returns

At a time when investors have experienced the worst quarter of market returns in perhaps their lifetime it is instructive to review the expectations of long range returns based on various levels of portfolio risk. Vanguard provides the following chart to illustrate that over the long term, a) diversified portfolios have stable expected annualized returns commensurate with their risk level and also that b) any one year can have significant volatility. Check it out…

Who is Middle Class Nowadays?

New research from the Pew Research center says it matters how big your household is…see below.

FEATURED

Top Read and Featured Articles

Bad Times for Active Stock Pickers

Almost no active managed funds have beaten the market/their benchmarks over the past 15 years. Some 66 percent of large-cap active managers failed to top the S&P 500 in 2016. Performance actually got worse over longer time frames, with more than 90 percent missing...

Talking Risk: Emotion vs. Data

We tend to base our assessment of risk on emotions (how we feel about it), and then rationalize (or try to) that we have done so using objective data. Our Reactions We overreact to risks we can’t control (like the fear of natural disasters) and under...

The Happiness Equation

To say that “money isn’t everything” is more than a cliché. Studies in the early 1970s demonstrated that a sense of well-being, or happiness, had not increased commensurately with income over the previous half century.1 That trend continues as the modern world has...

ERISA Bonds vs. Fiduciary Insurance

With so much attention lately on fiduciary duty, as well as the surge of fiduciary litigation this past year, plan sponsors would be wise to explore their insurance options. While the ERISA fidelity bond (also referred to as a “fidelity bond” or “ERISA bond”), is...

NYSE New Highs at Rare Levels – less than 10%

SUMMARY - in the very rare occurrence that less than 10% of NYSE stocks are making new highs, after-the-fact analysis shows these are likely markers of market bottoms. Subsequently, the broad market as followed with rebounds of 10% to 33% about 80% of the time....

Passive Investing Demonized

As sure as the sun rises in the east, the proponents of active management will continue to attack passive investing. The reason is simple: It threatens their livelihood. Thus, their behavior should not come as a surprise.Wall Street has ridiculed passive...